Positioning Aramco for the future

Aramco’s strategy is driven by its belief that reliable and affordable energy supplies, including oil and gas, will be required to meet the world’s growing energy demand, and that new lower-carbon energy supplies will gradually complement conventional sources. Aramco continues to work to achieve further reductions in greenhouse gas emissions from its oil and gas operations. Aramco also invests in technologies and solutions supporting the global energy and materials transition toward a lower-carbon emissions future. The world’s demand for affordable, reliable, and more sustainable energy will continue to grow, and Aramco believes it can best be met by a broad mix of energy solutions.

Within this context, Aramco’s vision is to be the world’s preeminent integrated energy and chemicals company, operating in a safe, sustainable, and reliable manner.

Aramco strives to provide reliable, affordable, and more sustainable energy to communities around the world, and to deliver value to its shareholders through business cycles by maintaining its preeminence in oil and gas production and its leading position in chemicals, aiming to capture value across the energy value chain and profitably growing its portfolio.

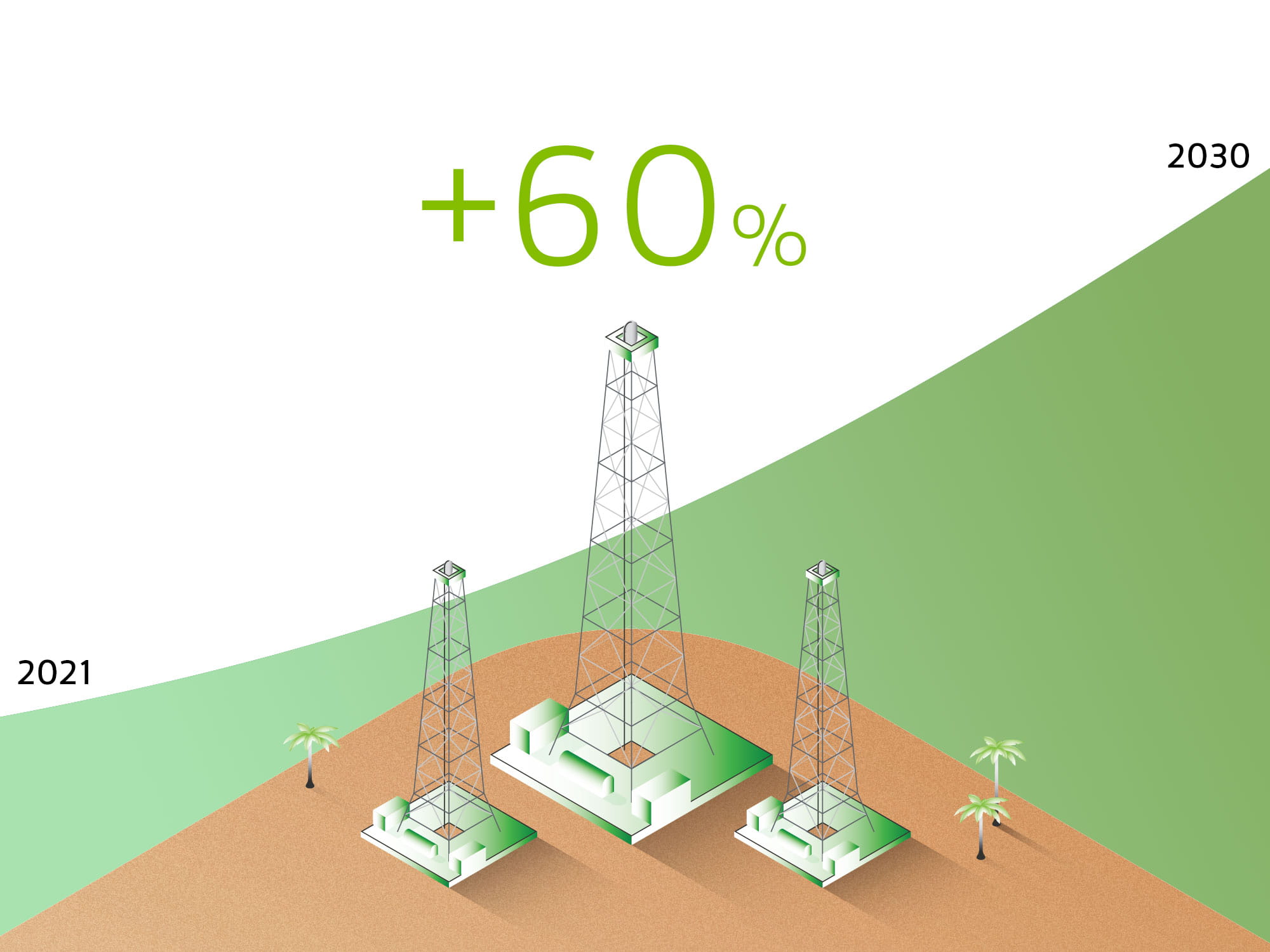

Upstream preeminence

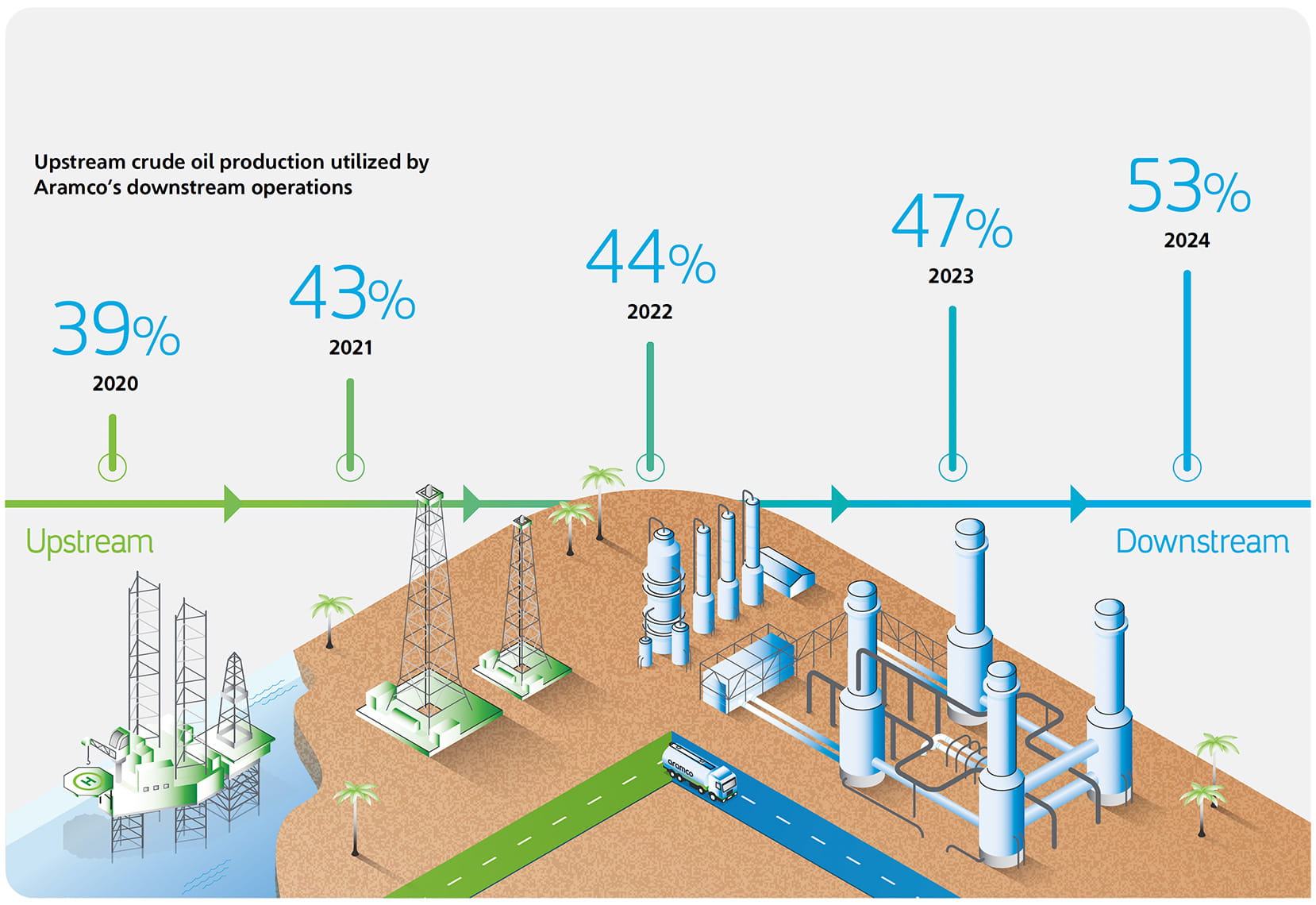

Downstream integration

Lower-carbon initiatives

Aramco aims to lower the net carbon emissions of its operations and support the global energy transition through development of a New Energies business that includes renewable power generation and lower-carbon products and solutions across the energy, chemicals, and materials sectors.

Aramco has ambitions to capture and store up to

9 million tons

of CO2 annually from Aramco facilities and other industrial sources by 2028, as part of the development of the Jubail carbon capture and storage hub.

Localization and the promotion of national champions

Aramco facilitates the development of a diverse, more sustainable, and globally competitive in-Kingdom energy ecosystem to underpin the Company’s competitiveness and support the Kingdom’s economic development.

Aramco is helping to build a world class local supply chain through its iktva program.

Percentage of total procurement expenditures locally sourced1

57.5%

2020

59.0%

2021

63.0%

2022

65.0%

2023

67.0%

2024

1. Applies to Saudi Arabian Oil Company (the Company).